A beneficiary designation form is a legal document used to specify who should receive certain assets or benefits when the account holder or policyholder dies. This form is typically used for financial accounts such as life insurance policies, retirement accounts, and bank accounts. The beneficiary designation form allows the account holder or policyholder to name one or more individuals, charities, or other entities as beneficiaries to receive the assets or benefits upon the account holder or policyholder's death. The beneficiary designation form typically requires the beneficiary's name, address, relationship to the account holder or policyholder, and percentage of the benefit or asset they are entitled to receive. The first section of the form typically requires the account or policy holder to provide their personal information, including name, address, Social Security number, and date of birth. The primary beneficiaries are the individuals or entities who will inherit the assets upon the account or policy holder's death. The form should include each primary beneficiary's name, address, Social Security number or tax identification number, date of birth, and relationship to the account or policy holder. Contingent beneficiaries inherit the assets if the primary beneficiaries are unable or unwilling to accept the inheritance. The form should include the same information for contingent beneficiaries as for primary beneficiaries. Some forms allow account or policy holders to include special instructions or conditions for the disbursement of assets, such as specifying a certain age for beneficiaries to receive the assets. Major life events, such as marriage, divorce, the birth or adoption of a child, or the death of a beneficiary, may necessitate changes to beneficiary designations. Account or policy holders should review and update their beneficiary designations accordingly. Failing to update beneficiary designations can result in assets being distributed to unintended recipients, leading to potential disputes among surviving family members and other beneficiaries. It is essential to review beneficiary designations periodically and update them as needed to ensure that assets are distributed according to the account or policy holder's wishes. When selecting beneficiaries, account or policy holders should consider factors such as the beneficiaries' financial needs, the account or policy holder's relationship with the beneficiaries, and the potential tax implications. Beneficiaries can include individuals, charities, trusts, or estates. Each type has specific implications, and account or policy holders should carefully consider their options before making a designation. Account or policy holders can choose from several options when designating beneficiaries, such as per stirpes (by branch), per capita (by head), or specific percentage allocations. Inherited assets may have tax implications for beneficiaries, depending on the type of account or policy and the amount received. Account or policy holders should consult with a financial advisor to understand the potential tax consequences for their beneficiaries. In some cases, spouses have specific rights to certain assets, such as retirement accounts. Account or policy holders should be aware of these rights and factor them into their beneficiary designations. Account or policy holders who wish to disinherit a family member must take specific steps to ensure their wishes are legally binding. Consulting an estate planning attorney can provide guidance in these situations. Beneficiary designations may be subject to legal disputes and challenges. Proper documentation and clear communication of intentions can help minimize the potential for disputes. To ensure the validity of beneficiary designations, account or policy holders must complete the form accurately and in its entirety. This includes providing all required information for primary and contingent beneficiaries, as well as any special instructions or conditions. Account or policy holders must sign and date the beneficiary designation form to make it legally binding. Failure to do so may result in the form being considered invalid, potentially leading to disputes and unintended distribution of assets. It is essential to store the completed beneficiary designation form in a safe and accessible location. Account or policy holders should provide copies of the form to their beneficiaries, financial advisors, and estate planning attorneys, if applicable. Informing beneficiaries of their designation and sharing the completed form with relevant parties can help ensure a smooth transition of assets upon the account or policy holder's death. This communication also provides an opportunity to address any questions or concerns that may arise. Financial advisors can offer valuable guidance on selecting and designating beneficiaries, as well as addressing potential tax implications for beneficiaries. They can help account or policy holders make informed decisions about their estate planning. Estate planning attorneys can provide legal advice on beneficiary designations and help ensure that account or policy holders' intentions are legally enforceable. They can also assist with more complex estate planning needs, such as creating trusts or drafting wills. By consulting with financial advisors and estate planning attorneys, account or policy holders can create a comprehensive estate plan that addresses all aspects of their financial and personal affairs. Beneficiary designation forms play a critical role in estate planning and the distribution of assets upon one's death. It is essential to keep beneficiary designations updated, select appropriate beneficiaries, and follow best practices for completing and storing these forms. Additionally, seeking professional guidance can help account or policy holders navigate complex situations and ensure a comprehensive estate plan.What Is a Beneficiary Designation Form?

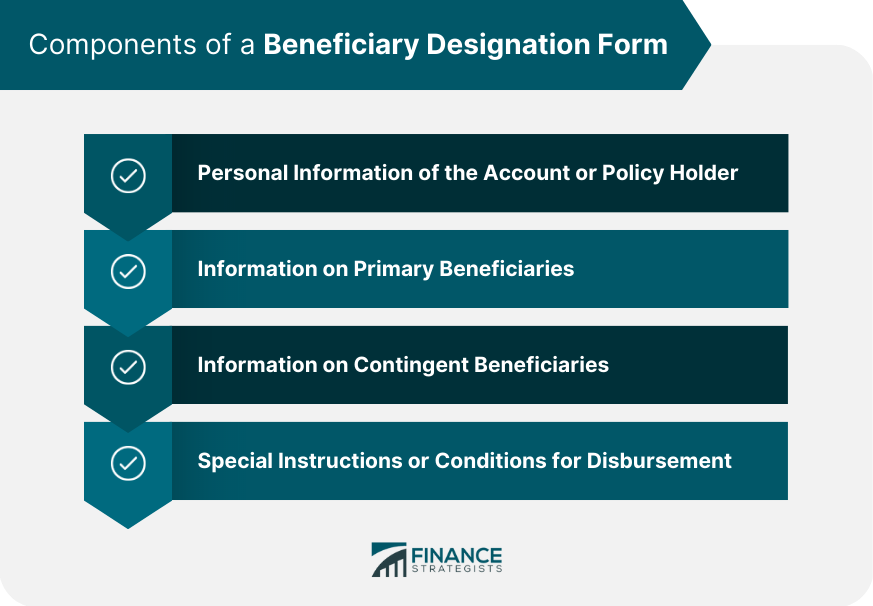

Components of a Beneficiary Designation Form

Personal Information of the Account or Policy Holder

Information on Primary Beneficiaries

Information on Contingent Beneficiaries

Special Instructions or Conditions for Disbursement

Importance of Keeping Beneficiary Designations Updated

Life Events That Warrant Updating Beneficiary Designations

Consequences of Not Updating Beneficiary Designations

Regular Review and Updating of Beneficiary Designations

Selecting and Designating Beneficiaries

Factors to Consider When Choosing Beneficiaries

Types of Beneficiaries

Beneficiary Designation Options

Legal and Tax Considerations

Tax Implications for Beneficiaries

Spousal Rights and Implications

Disinheriting Family Members

Legal Disputes and Challenges

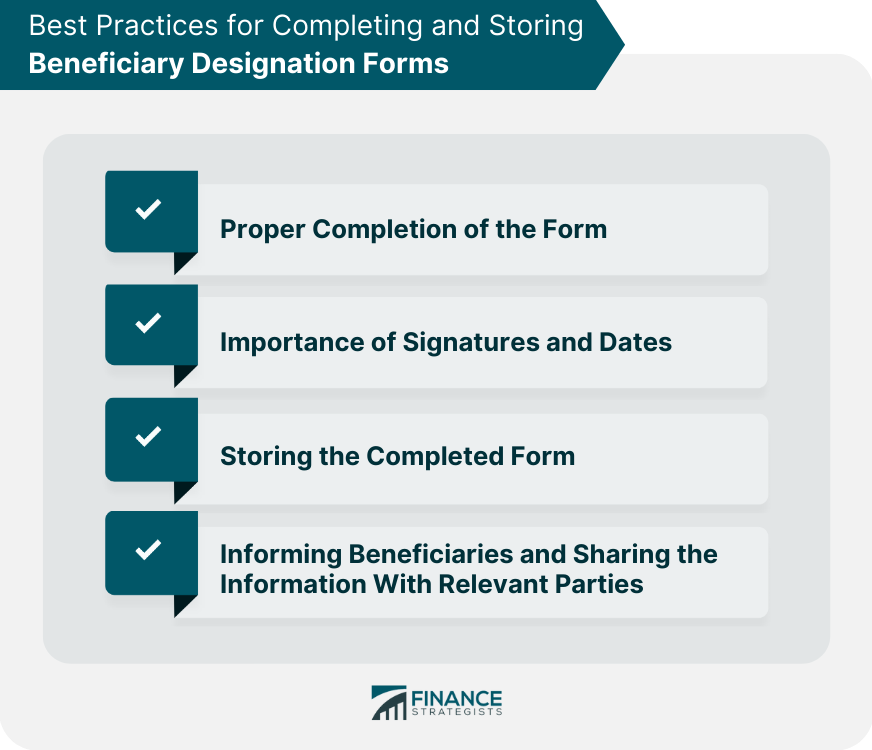

Best Practices for Completing and Storing Beneficiary Designation Forms

Proper Completion of the Form

Importance of Signatures and Dates

Storing the Completed Form

Informing Beneficiaries and Sharing the Information With Relevant Parties

Seeking Professional Guidance

Consulting a Financial Advisor

Working With an Estate Planning Attorney

Using Professional Resources to Ensure a Comprehensive Estate Plan

Conclusion

Beneficiary Designation Form FAQs

A beneficiary designation form is a legal document that allows you to name one or more individuals or organizations as beneficiaries to receive certain assets, such as life insurance policies or retirement accounts, upon your death.

You can name anyone as a beneficiary on a beneficiary designation form, including family members, friends, or charities. It's important to consider any legal requirements or tax implications when making your selections.

Yes, it is important to complete a beneficiary designation form for each account that allows you to name a beneficiary. This helps ensure that your assets are distributed according to your wishes and avoids any confusion or disputes among potential beneficiaries.

Yes, you can generally update your beneficiary designation at any time by completing a new form. It is important to review and update your beneficiaries periodically, especially after significant life events like marriage, divorce, or the birth of a child.

No, you do not necessarily need an attorney to complete a beneficiary designation form. However, if you have complex estate planning needs or are unsure about how to designate beneficiaries, it may be helpful to consult with an estate planning attorney or financial advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.