A central bank is an independent financial institution that regulates and issues the currency of a country or region. It also serves as a banker to governments, commercial banks, and other regional financial institutions. It primarily promotes economic stability by acting as an emergency lender in times of crisis, setting monetary policy, influencing interest rates, and making liquidity available through loans and asset purchases. Central banks are non-market-based institutions independent of the government, although they may be owned by it. As such, they are deemed politically independent, given their focus on economic stability rather than political considerations. Nonetheless, a central bank's activities have far-reaching implications, affecting the value of a country's currency, the cost and availability of credit, overall economic performance, and even political and social conditions. Central banks have been around for centuries, with the earliest known example being the Bank of Sweden, established in 1668. Initially, these institutions were set up to help governments borrow money and manage public debt. During times of war, for example, central banks would facilitate large-scale borrowing by issuing bonds. Over time, however, the role of the central bank evolved and expanded. The Bank of England was created in 1694, marking an important milestone in the development of Central Banks. It was given a monopoly to issue currency and had broad regulatory powers over commercial banking activities. It eventually led to the establishment of other central banks in Europe, such as the one in France during the 19th century. The Federal Reserve System (Fed) was created in the United States in 1913 through the Federal Reserve Act. The gold standard was implemented then, making currencies convertible into gold. It meant that the central banks could manage the money supply by controlling the amount of gold in their reserves. The Bretton Woods Agreement of 1944 was responsible for establishing a new international monetary system based on fixed exchange rates between different currencies. With this, nations agreed to peg their currencies and hold foreign exchange reserves to the U.S. dollar. The Bretton Woods System was abandoned in 1971, marking a shift towards more flexible exchange rates, which allowed central banks greater freedom to determine monetary policy for domestic economies. Today, central banks operate in three principal ways: Central banks are responsible for a nation's money supply. It involves managing the availability of loanable funds for businesses, consumers, and national governments. The aim is to ensure that the economy remains stable and maintains a low inflation rate. By adjusting interest rates, buying or selling government bonds, and other economic tools, central banks can influence how much liquidity is available in the economy at any given time. For example, a central bank may raise interest rates to slow an overheated economy, discourage investors from taking on too much risk, and avoid inflation. On the other hand, they could lower interest rates to stimulate consumer spending, encourage investment, and promote employment. Central banks have the authority to inspect and supervise commercial banks and other financial institutions. The goal is to protect the integrity of the banking system by ensuring that these institutions are financially sound and compliant with laws and regulations. Central banks can impose regulations on lending practices, set capital requirements for banks, and require that those institutions follow certain guidelines for activities such as issuing loans or extending credit. Central banks provide emergency liquidity to the banking system when needed. It can lend to an institution in times of financial stress, such as offering loans to keep a commercial bank afloat or providing funds to stabilize struggling governments. Being a lender of last resort ensures that credit continues to flow throughout the economy and prevents widespread panic during a crisis. Central banks help mitigate the effects of economic downturns on governments, businesses, and families alike. The actions taken by central banks do not guarantee success, but they often make it easier for nations to navigate difficult economic conditions. In doing so, central banks play an important role in promoting economic stability and sustainable growth over time. The Federal Reserve System is arguably the world's most well-known and influential central bank. Since around 90% of the world's currency transactions use the U.S. dollar, the Fed's activities comprehensively impact the cost of many currencies. The Fed has five general functions to secure the efficiency of the U.S. economy and the public interest. It manages monetary policy, maintains financial stability, promotes strong institutions, ensures safe payment and settlement systems, and protects consumer interests. The Federal Reserve System is structured into three groups: the Board of Governors, the Federal Reserve Banks, and the Federal Open Market Committee (FOMC). Located in Washington, D.C., this group is composed of seven members that are selected by the President of the United States and approved by the Senate. Members report directly to Congress and serve 14-year terms. The Board is responsible for setting monetary policy and regulating financial institutions within its jurisdiction. Board members also sit at the FMOC. The Federal Reserve Banks are located in twelve regions across the U.S.: Atlanta, Boston, Chicago, Cleveland, Dallas, Kansas City, Minneapolis, New York, Philadelphia, Richmond, San Francisco, and St. Louis. The Federal Reserve Banks operate independently from each other but together form part of an influential international banking system that works to shape global economic policy. The FOMC is the main decision-making body of the Fed and is responsible for setting monetary policy. The FOMC meets eight times yearly to make decisions related to the money supply, price stability, and economic conditions. It brings together the Board of Governors and the presidents of the 12 Federal Reserve Banks. The head of the Board of Governors is also the chair of the FOMC. A central bank is a financial institution that governs a nation's monetary policy. Its main functions include controlling the money supply, regulating banks and other institutions, and acting as a lender of last resort. The first central banks were established in Europe in the 17th Century. In the United States, this role is held by the Federal Reserve System, which is composed of the Board of Governors, the Reserve Banks, and the FOMC. The Fed was created in 1913. The Fed is the most influential central bank in the world. Its policies affect the U.S. economy and impact other currencies and economies globally. Consult a financial advisor for further information about the Fed, central banks, and banking in general. It can help you better understand policies and activities and how they can affect your financial well-being.What Is a Central Bank?

History of Central Banks

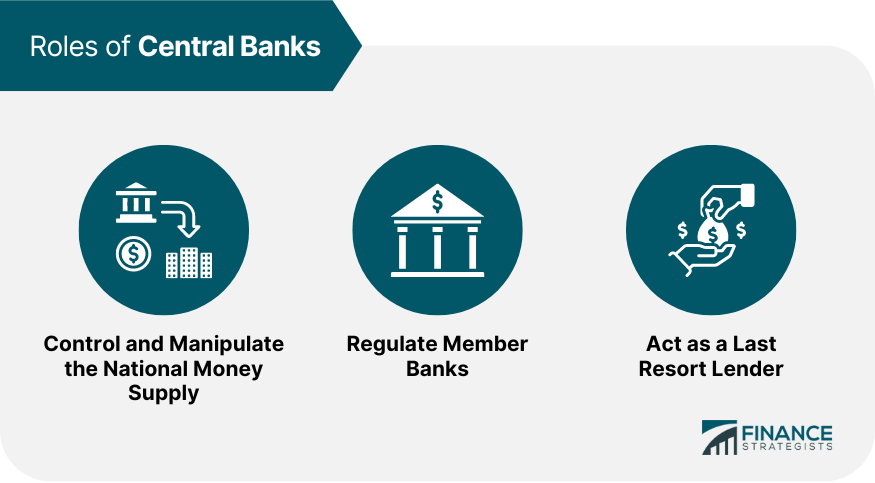

Roles of Central Banks

Control and Manipulate the National Money Supply

Regulate Member Banks

Act as a Last Resort Lender

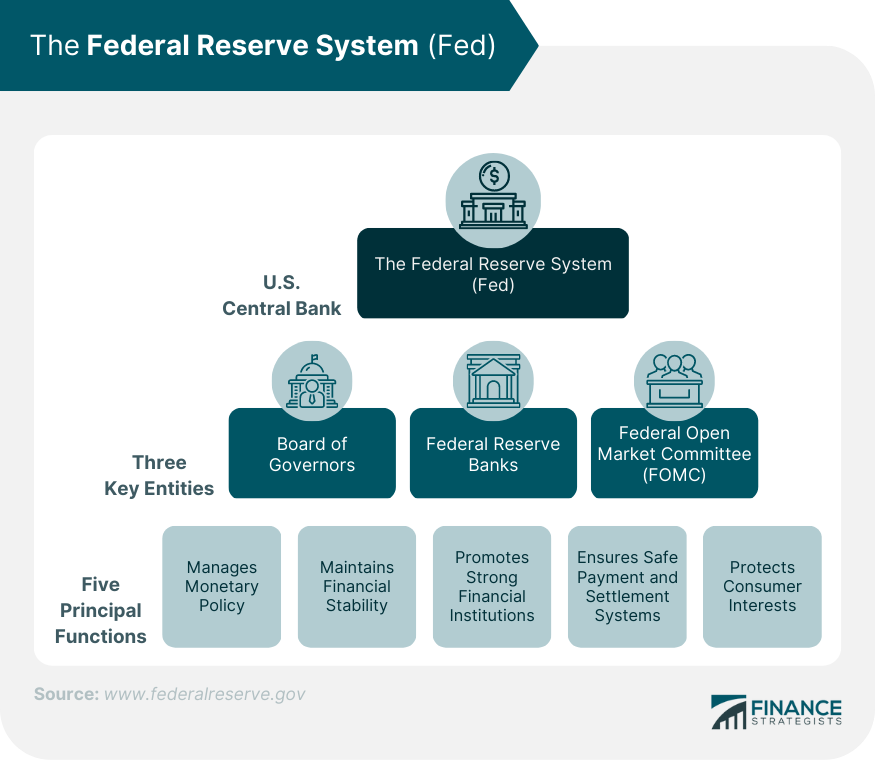

U.S. Central Bank: Federal Reserve System (Fed)

The Board of Governors

The Federal Reserve Banks

The Federal Open Market Committee

Final Thoughts

Central Bank FAQs

Central banks are important because they issue and control a country's currency, regulate its banks, and act as emergency lenders. Central banks help maintain financial stability and impact a country's economic performance.

Central banks around the world have myriad roles for their respective countries. Nonetheless, the main functions include controlling money supply and policy, regulating commercial banks and other institutions, and acting as lenders of last resort.

Yes. Central banks are responsible for setting monetary policy, including the amount of printed and circulated money.

Yes. Most central banks are independent of the governments that create them and operate according to mandates outlined in their charters. However, political pressure can still affect the operations of a central bank.

Yes. The Federal Reserve System is the U.S. central bank and is independent from the government but subject to certain regulations by Congress.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.